PropTech 2.0 may just change everything about the real estate industry

KUALA LUMPUR (March 3): The second wave of proptech is expected to bring bigger changes to how property is bought and sold, said EdgeProp.sg CEO Bernard Tong.

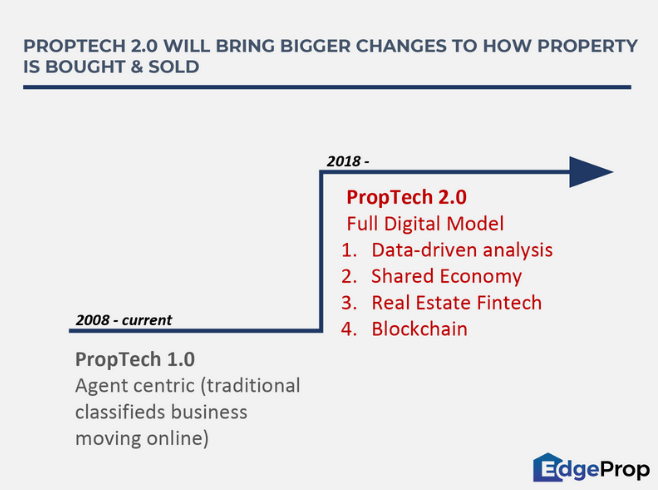

“The first wave of prop tech or PropTech1.0 is really about bringing real estate information online so that consumers have insightful information to help them make better decisions, instead of solely relying on an agent,” he said at the Malaysian Annual Real Estate Convention 2018 (MAREC ’18).

* MIEA urges public to deal with registered agents

* PNB: No concern on office space oversupply

* Real estate agencies should consider multi-level marketing formula for commissions

* Real estate agents urged to use proptech to offer better services to clients

* Rehda: Malaysia’s property industry must tap into big data

“PropTech 1.0 companies – including EdgeProp.my and EdgeProp.sg – are mainly lead-generating businesses for agents, focused on sending them highly-qualified leads.

“It is agent centric – nothing different from print classifieds businesses in the past,” he added.

However, PropTech 2.0 – which is poised to take off this year – may just change everything about the industry, from the way real estate professionals, buyers, sellers and banks think about transactions involving property, to how these transactions are done today.

According to Tong, there are four key drivers to PropTech 2.0: data-driven analysis, shared economy, real estate fintech and blockchain.

“Data mining is trawling in-depth data and making use of the data by organising them. While the shared economy describes tech platforms which facilitate the use of property.

“It means real estate of the future may no longer be about buying and selling – it will be a lifelong investment that will have a lifestyle from private use to investment, to shared asset and back again. Millennials prefer to invest and rent, rather than own.

“While real estate fintech describes tech platforms which facilitate the trading of real estate asset ownership and leasing. For example, real estate crowdfunding has the potential to resolve the capital requirement problem for many aspiring homeowners and remove geographical barriers. What this means is that the potential buyer base will become larger, as well as the pool of available capital.

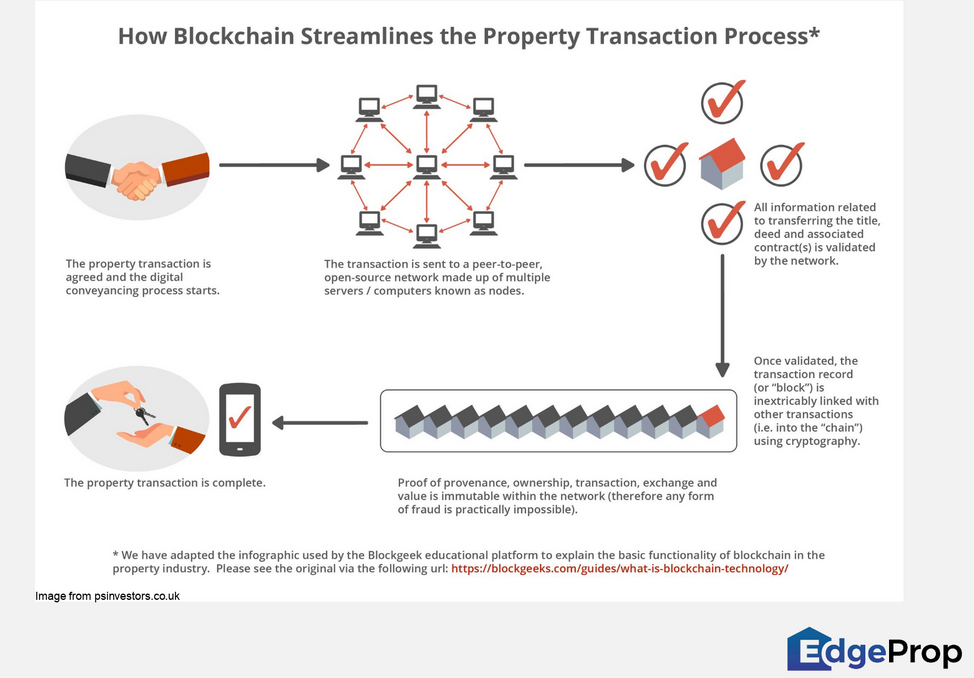

“While all these innovations have the potential to speed up the process of information exchange, the market is still largely dependent on intermediaries. This is where blockchain could be a game changer,” he explained.

Whatever happens, one thing is clear: real estate services will become digital, simple, personalised and cheap, said Tong.

“The real estate sector is ripe for change. The reason that it has been slow to change in the past is because it has very little speed. PropTech 2.0 drivers such as real estate fintech and the sharing economy are creating the building blocks that will make it easier, cheaper and faster to buy and sell property. This means speed will go up.

“Investors are starting to take notice. Funding for proptech companies have gone up over 10 times in the last five years. Sums invested means a truly transformative proptech movement is underway.

“For real estate negotiators who know how to play the digital game - the opportunities are endless,” he added.

Tong was speaking on the topic of “PropTech 2.0: Implications of data-driven analysis, fintech, sharing economy and blockchain to real estate”.

The two-day event which kicked off on March 2 was organised by the Malaysian Institute of Estate Agents (MIEA). EdgeProp.my is the digital media partner of the event.

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Telegram

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.