Ekovest Bhd (Feb 8, RM0.955)

Initiate buy with fair value (FV) of RM1.35: Dubbed the urban road connector through its highway flagship Duta-Ulu Kelang Expressway, Ekovest plans to add 10 potential alignments in future to cater to growing traffic, ensuring seamless commuting within Kuala Lumpur. Ekovest’s earnings visibility in the coming years remains upbeat underpinned by the following factors:

i) Strong outstanding order book which currently stands at an all-time high of RM14 billion, keeping it busy for the next three to five years. Infrastructure-related jobs like the construction of the Setiawangsa-Pantai Expressway, Pan Borneo Highway and DUKE 2 represent the bulk of its sturdy order book (about 85% of total order book).

ii) Steady recurring incomes from its toll concession activities, that is DUKE 1 and 2, for a concession period up to August 2069. The lucrative concession business has also attracted institutional investors like the Employees Provident Fund which currently owns 40% of the concession business. It is well positioned to benefit from the next upcycle in the property market via more aggressive property launches from its prime strategic land banks along Kuala Lumpur River City.

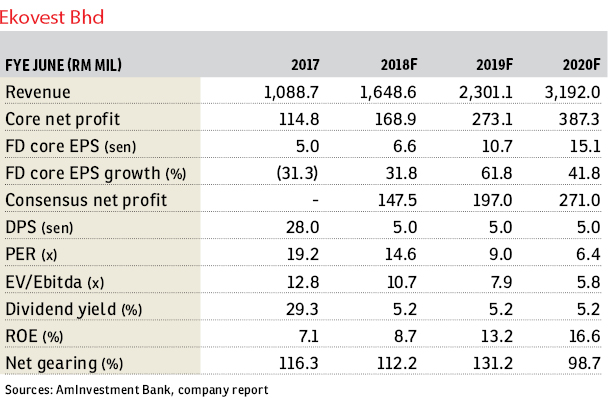

Meanwhile, we believe the market has overreacted negatively to Ekovest’s proposed acquisition of Iskandar Waterfront City. This is reflected in its share price trading at a steep 50% discount to our base-case sum-of-parts (SOP) valuation of RM1.80. For FY18, based on our projection, its construction division will contribute 80% of overall earnings, with the remaining 10% each from toll concession and property divisions.

We initiate coverage on Ekovest with a “buy” call and FV of RM1.35 based on a 25% discount to our SOP value. — AmInvestment Bank, Feb 8

This article first appeared in The Edge Financial Daily, on Feb 9, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Pulau Indah Industrial Area

Pulau Indah (Pulau Lumut), Selangor