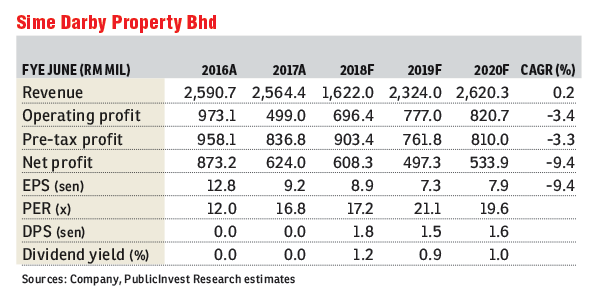

Sime Darby Property Bhd (Jan 16, RM1.52)

Initiate coverage with an outperform recommendation and a target price (TP) of RM1.90: Sime Darby Property Bhd (SDPR), which is part of Sime Darby Group’s pure play strategy to create three separate listed entities, has potential to unlock its vast strategically located land bank measuring 20,763 acres (8,402.49ha) with an estimated gross development value of RM100 billion.

We initiate coverage of SDPR with an “outperform” recommendation, with a TP of RM1.90, pegged at a 40% discount to our revalued net asset value estimate.

Albeit property sales for the group are still below its potential (given its vast land bank) at an average of RM2 billion per annum for the last few years, we believe the value in its holdings is too big to ignore.

Recent revaluation for its land bank alone totals RM18.8 billion, with net gearing at almost zero. A potential catalyst is asset monetisation, which is also part of the group’s strategy to assess the best use of each piece of land, while disposing of non-strategic land.

Given its large tracts of land, we believe SDPR would continue to unlock land value via an outright disposal or collaboration with strategic partners. Rightsizing its landbank is essential to ensure the optimal use of the group’s resources. As with current property sales for the group at only RM2 billion per annum, it will take at least 50 years to develop its current landbank vis-à-vis its target of 15 to 20 years.

The group is currently developing 23 townships, integrated and niche property development projects on 12,026 acres (58% of total land bank), with the remaining 8,737 acres of land for future development.

The land bank, we understand, is mainly located near major highways and within key growth areas and economic corridors in Peninsular Malaysia with low historical holding costs.

SPDR’s market segment is broad-based, covering integrated mixed developments, residential strata, transport-oriented-developments/transport-adjacent-developments, premium/branded lifestyle and the industrial segment.

Investment assets include its property investment and leisure and hospitality divisions, which are managing commercial spaces measuring two million square foot (key assets such as Melawati Mall and KL East Gallery) and properties such as the Sime Darby Convention Centre, TPC Kuala Lumpur, Impiana Golf and Country Club, Darby Park Serviced Residences (Australia), Darby Park Executive Suites (Singapore) and Darby Park Serviced Residences (Vietnam).

The group aims to grow recurring income to 10% of its operating profit in the next five years, and potentially more than 10% beyond that. — PublicInvest Research, Jan 16

This article first appeared in The Edge Financial Daily, on Jan 17, 2018.

For more stories, download EdgeProp.my pullout here for free.