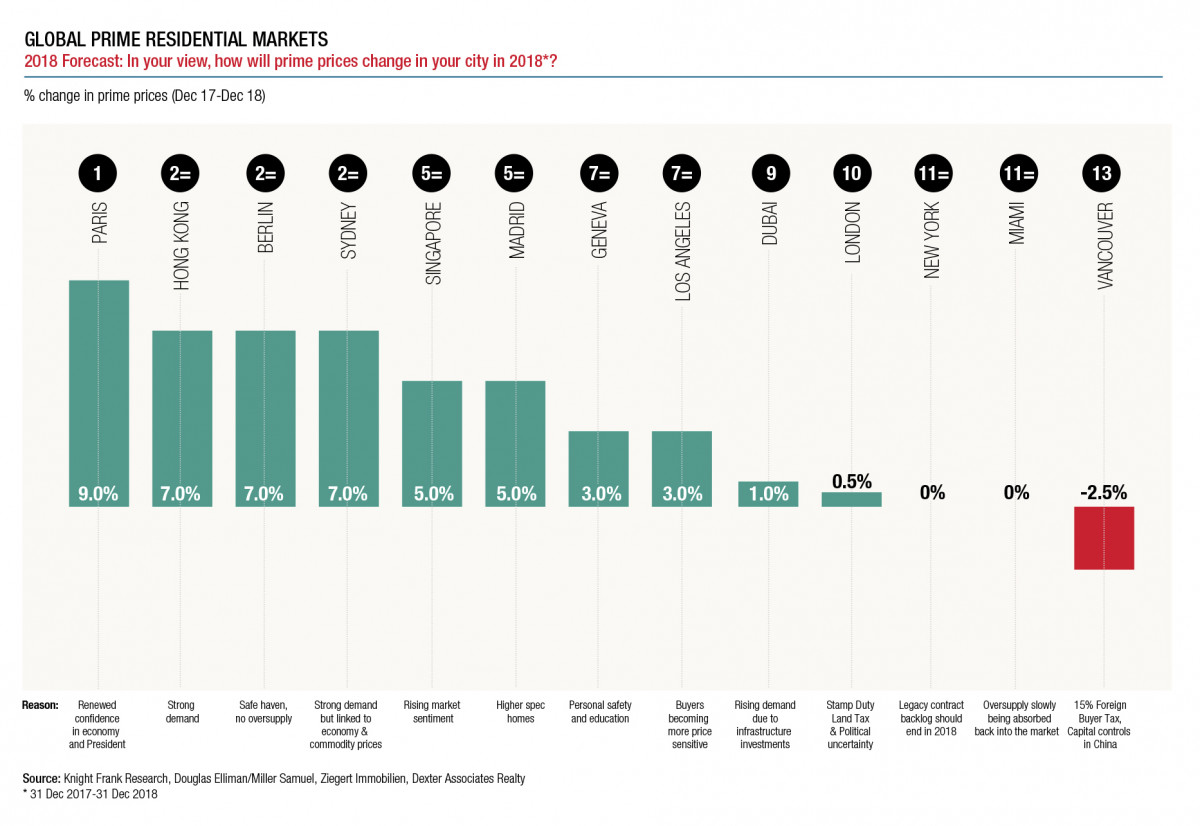

PETALING JAYA (Dec 18): Paris tops the list of cities with most growth potential, with a projected 9% price growth following years of slow capital appreciation as it benefits from the Eurozone’s improved economic outlook, said global property consultancy Knight Frank.

France’s capital is back on the investment radar of global investors, particularly those from the US, the Middle East and Europe, said the consultancy in its Prime Residential City Forecasts 2018.

Hong Kong takes second place out of a list of 13 cities worldwide.

“Hong Kong, with ongoing demand from mainland China, is likely to post the strongest growth of major Asian urban markets during 2018 with a 7% rise by the year-end,” said Knight Frank.

Meanwhile, Dubai is likely to experience modest growth next year, following a weaker performance during the recent market cycle, buoyed by government spending in the economy and infrastructure leading to Expo2020, which is boosting employment and demand in turn.

Singapore and Geneva, which are expected to demonstrate growth of 5% and 3% respectively, are tapped to be the most improved markets next year.

“Singapore’s luxury residential market, in the doldrums for several years, is expected to shift up a gear in 2018 as market sentiment improves.

“Geneva, off-limits for non-resident buyers, offers safety, privacy and unrivalled schools, putting it high on the list of wealthy families looking to relocate.

“In Central London, prime prices are expected to rise marginally by 0.5% in 2018, with cumulative price growth over the next five years reaching 13.1%.

“While London’s fortunes will continue to be buffeted by taxation and the outlook for the pound, Brexit and its impact on employment will be the overriding issue to watch.

“Uncertainty on this pivotal issue means we are not expecting prices to rise significantly in 2018; we do believe that recent price falls will help transactions to continue to pick up from the lows they hit in 2016,” it said.

Meanwhile, Los Angeles values are expected to continue trending up — projected at 3% next year — underpinned by an imbalance in supply and demand.

On the other hand, New York and Miami’s prime markets are still affected by higher inventory volume, and are expected to mirror the flat growth of London’s price performance in 2018.

Knight Frank expected Vancouver to be the only city where prime residential prices will soften next year, albeit only marginally at 2.5%.

Demand was affected by a foreign buyer tax introduced in 2016 and tighter capital controls in China.

TOP PICKS BY EDGEPROP

Pinggiran Kiara

Taman Tun Dr Ismail, Kuala Lumpur

Taman Tun Dr Ismail (TTDI)

Taman Tun Dr Ismail, Kuala Lumpur

Taman Tun Dr Ismail (TTDI)

Taman Tun Dr Ismail, Kuala Lumpur

Taman Tun Dr Ismail (TTDI)

Taman Tun Dr Ismail, Kuala Lumpur

Taman Tun Dr Ismail (TTDI)

Taman Tun Dr Ismail, Kuala Lumpur

Taman Tun Dr Ismail (TTDI)

Taman Tun Dr Ismail, Kuala Lumpur

Taman Tun Dr Ismail (TTDI)

Taman Tun Dr Ismail, Kuala Lumpur

Taman Tun Dr Ismail (TTDI)

Taman Tun Dr Ismail, Kuala Lumpur

Taman Tun Dr Ismail (TTDI)

Taman Tun Dr Ismail, Kuala Lumpur

Taman Tun Dr Ismail (TTDI)

Taman Tun Dr Ismail, Kuala Lumpur

Taman Tun Dr Ismail (TTDI)

Taman Tun Dr Ismail, Kuala Lumpur

Taman Tun Dr Ismail (TTDI)

Taman Tun Dr Ismail, Kuala Lumpur

Taman Tun Dr Ismail (TTDI)

Taman Tun Dr Ismail, Kuala Lumpur

Taman Tun Dr Ismail (TTDI)

Taman Tun Dr Ismail, Kuala Lumpur

Taman Tun Dr Ismail (TTDI)

Taman Tun Dr Ismail, Kuala Lumpur

Taman Tun Dr Ismail (TTDI)

Taman Tun Dr Ismail, Kuala Lumpur

Taman Tun Dr Ismail (TTDI)

Taman Tun Dr Ismail, Kuala Lumpur