Property sector

Maintain neutral: The first half of calendar year 2017 (1H2017) results were broadly in line with half of our stock coverage (four out of eight) which came in within expectations (three below, one above). Although reported earnings were hardly exciting, stronger 2H2017 earnings have been guided by most companies. 1H2017 recorded sales are on course to meet the 2017 target (flat year-on-year [y-o-y]) given expectation of a stronger 2H2017. There has been no downward revision of sales target by companies under our coverage.

More land-banking exercises are expected going forward. Year to date (YTD), Sunway Bhd and Mah Sing Group Bhd are among the more aggressive parties with five and four land acquisitions respectively. Matrix Concepts Holdings Bhd continued to expand its landbank in Negeri Sembilan, while Ibraco Bhd had recently announced a land deal in the Klang Valley. Besides, S P Setia Bhd successfully tendered for a land in Singapore back in April.

There is rebound in leading loan indicator. YTD, monthly loan applications and approvals for residential properties were up 16.8% and 18.2% y-o-y, bucking the declining trend in 2016. This indicates buyers’ interest has improved despite the low approval rate due to a stringent bank lending policy. The improving economic environment should lend support to a gradual recovery in the property sector. In this regard, we can expect a return of interest in the sector given a rising appetite in the domestic growth upcycle theme.

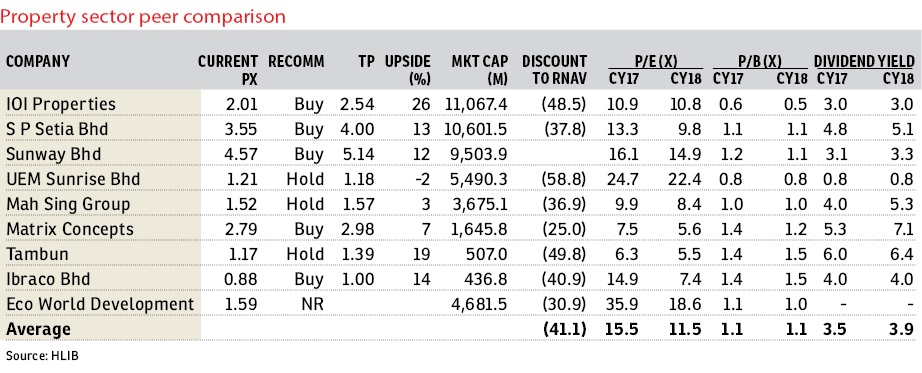

Sector valuation at -one standard deviation below average where it is currently trading at a 48% discount to revalued net asset value (RNAV) and 0.96 times price-to-book. Valuation is still relatively cheap and we expect the discount to narrow when the property sector begins to gain more interest amid signs of bottoming up.

We maintain a “neutral” stance on the sector due to the absence of near-term catalysts despite bottoming signs.

Our top picks are Sunway and S P Setia. On Sunway (“buy” call with a TP of RM5.16): A rerating catalyst given its diversified income stream and declassification from property sector. We continue to advocate it as a deep value stock with mature investment properties and the underappreciated trading and healthcare segments, which are undergoing massive expansions. Potential higher dividend of more than 3% is another investment merit.

On S P Setia (“buy” call with TP of RM4): We remain “positive” on the imminent synergistic acquisition of the I&P Group given its attractive price and RNAV accretive as well as boosting of overall land bank to 9,500 acres (3,844ha) [third largest]. Consistent dividend yield of 5% is also a positive point. — Hong Leong Investment Bank Research, Sept 18

This article first appeared in The Edge Financial Daily, on Sept 19, 2017.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Medan Idaman Business Centre

Setapak, Kuala Lumpur

Taman Suria

Jalan Klang Lama (Old Klang Road), Kuala Lumpur