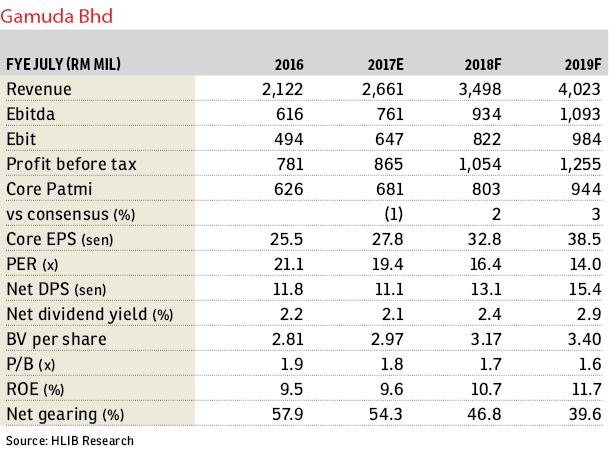

Gamuda Bhd (Aug 2, RM5.40)

Maintain buy with a higher target price (TP) of RM6.36: Gamuda Bhd’s order book stands at RM16 billion (including mass rapid transit 2 [MRT2] project delivery partner), implying a strong cover of 6.6 times on FY16 construction revenue. Management is hopeful to add at least another RM10 billion to its bag over the next one to two years.

Key jobs eyed include the East Coast Rail Link (ECRL), MRT3, high-speed rail linking Kuala Lumpur to Singapore, and Pan Borneo Highway in Sabah.

Public display of the mammoth 600km ECRL worth RM55 billion ended in June with initial awards expected in the fourth quarter of 2017 (4Q17). Although China Communications Construction Co is the lead contractor, we gather that as much as 30% to 40% or RM16 billion to RM22 billion of the works would be subcontracted to locals. Management guides that it is eyeing a sizable portion of these subcontracts and will leverage its track record with the northern double-track project.

Project details on the MRT3 is being finalised by Suruhanjaya Pengangkutan Awam Darat. Cabinet approval is anticipated by mid-2018 with project roll-out in early 2019. MRT3 will integrate with other radial rail lines via its orbital alignment, commonly known as the “wheel and spokes” concept.

As it will pass through densely populated areas with high buildings, more than 50% of its alignment will be underground. This plays in Gamuda’s favour as it can undertake a higher degree of underground works given its experience with MRT1 and MRT2. Preliminary estimates place the MRT3’s cost at RM40 billion.

Our house view is for the 14th general election to be held in March 2018. We view Gamuda as a potential post-election play as approval for the Penang Transport Master Plan and disposal of Syarikat Pengeluar Air Sungai Selangor Sdn Bhd is likely to materialise after the polls. The former would provide another strong boost to the order book while the latter would infuse Gamuda with RM1.2 billion of cash, equivalent to 49 sen per share.

Management is confident that it can surpass its financial year 2017 (FY17) property sales target of RM2.1 billion. For FY18, this could potentially hit a new high of RM3 billion driven by the launch of new townships such as Gamuda Gardens and Kundang Estates.

Gamuda’s earnings upcycle is poised to hit another round of multi-year highs in FY18 and FY19. It is also a key play to ride on the upcoming mega rail projects such as the ECRL and MRT3.

Following our earnings upgrade, our TP is raised from RM6.24 to RM6.36, implying FY18 and FY19 price-earnings ratio of 19.4 times and 16.5 times respectively. — Hong Leong Investment Bank Research, Aug 2

This article first appeared in The Edge Financial Daily, on Aug 3, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Flat Tasek 64, Bandar Baru Seri Alam

Masai, Johor

Jalan Setia Utama U13/38C

Setia Alam/Alam Nusantara, Selangor