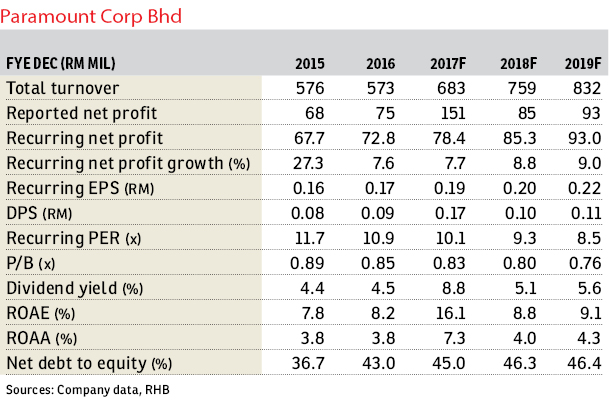

Paramount Corp Bhd (Aug 2, RM1.84)

Maintain buy with a higher target price (TP) of RM2.37: Paramount Corp Bhd announced its disposal of the Sri KDU campus to Alpha Real Estate Investment Trust (REIT), which is an unlisted Islamic education REIT backed by the Employees Provident Fund, for a total cash consideration of RM165 million. The company has also entered into a triple-net lease agreement with the REIT to lease the property for 10 +10 years, at a rental yield of around 7%.

Of the RM165 million in proceeds, about RM113 million would be used to pare down borrowings. RM31.8 million would be allocated for a special dividend, which should be paid after the transaction is completed in fourth quarter of 2017 (4Q17). This translates into a payout of 7.5 sen per share. Including our financial year 2017 (FY17) dividend per share forecast of nine sen, forecasted FY17 dividend yield may potentially hit 8.8%.

We believe Paramount is just beginning to monetise its assets. This is in line with the asset-light strategy that its chief executive officer, Jeffrey Chew, has always emphasised on. Among other assets that can be monetised in future are the three REAL school campuses, as well as the listing of the education division. We think these are among the rerating catalysts in the pipeline that could potentially drive its share price over the next one to two years.

For the property development division, we understand that Paramount would likely exceed its full-year property sales target of RM500 million, as its sales in the first half of this year have been very encouraging. Management indicated that its Batu Kawan Utropolis project has seen strong demand, as the growth prospects at Batu Kawan become more visible with the opening of Design Village, as well as the ongoing construction works of the KDU campus, Aspen Vision City and the Ikea outlet.

Unbilled sales as at 1Q17 stood at RM506 million.

We revise our FY18-FY19 earnings forecasts down slightly by 1%-2%. The overall impact on earnings is minimal, as the new rental expense for Sri KDU would be largely offset by the savings in interest cost and depreciation. After paring down the debt, Paramount’s net gearing is expected to improve to around 40%, from 46% currently.

We maintain our “buy” rating on Paramount and lift our TP to RM2.37, from RM2.24, to account for the disposal gain of RM72.9 million. This is based on an unchanged 55% discount to its property revalued net asset value and a 20% sum-of-parts discount.

We believe the asset monetisation catalysts as well as the attractive dividend yield would continue to drive investors’ interest in the stock. Downside risks to our call include weaker-than-expected market conditions. — RHB Research Institute, Aug 2

This article first appeared in The Edge Financial Daily, on Aug 3, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

REDEARTH GENTING XINTIANDI

Genting Highlands, Pahang

Flat Tasek 64, Bandar Baru Seri Alam

Masai, Johor

Jalan Setia Utama U13/38C

Setia Alam/Alam Nusantara, Selangor