Location has always been one of the key considerations in ensuring asset value growth and a property neighbouring a cemetery is definitely not the location of choice.

However, land scarcity in urban areas has pushed developments to whatever land is available, even next to cemeteries.

For example, new property launches have never seen a pause in areas surrounding the Muslim cemetery in Jalan Ampang because it is located right at the heart of Kuala Lumpur city centre, where development land is in high demand, cites Laurelcap Sdn Bhd director Stanley Toh.

There have also been some instances where property owners unknowingly find themselves having a new cemetery as their neighbour. For instance, vacant lands next to a proposed development could have been earmarked by the local council for a cemetery, but the developer failed to disclose that to their purchasers.

“Many years after the development’s completion, the local council then decides to start building the cemetery. An example is the Bukit Kiara 2 Muslim cemetery which is being constructed now, after some of the high-end residential developments have been completed a couple of years ago,” Toh tells TheEdgeProperty.com.

Good location or otherwise, many Malaysians — especially the Chinese — consider it a taboo to live next to a cemetery or graveyard, according to real estate agents.

“There is still a stigma in buying properties next to graveyards as Malaysians are still quite ‘pantang’ and superstitious. Nevertheless, some developers and investors do not mind taking the risk by betting on the address against the stigma,” says Toh.

One Sunterra Properties Sdn Bhd principal Sara Lai also says that the market does not widely accept a property near burial grounds. “Generally, prices are lower and value appreciation is slower compared with other properties,” she adds.

However, she notes that there are exceptions and not all properties next to cemeteries are equally affected. The building may be near a cemetery but in some of its units, you may not be able to see the cemetery; hence, these units will fare better than those with views of the cemetery, she offers.

“So the value of the property may not necessarily be affected unless the units directly face the graveyards or share the same access,” she adds.

Based on Hartamas Real Estate (OUG) Sdn Bhd team manager Janet Chong’s experience, properties nearby cemeteries may be cheaper than one further away but they remain rather unpopular.

“I have never heard of any property buyer or investor who buys properties near graveyards because of their lower prices,” she shares, adding that agents usually try to avoid taking on such units due to lack of demand.

By her estimates, units with a direct graveyard view will generally be 10% to 15% cheaper than a normal unit.

“On the secondary property market, the Chinese are the biggest buyers, at least for my team. And graveyards are the No. 1 taboo for them,” Chong notes.

Defying taboos

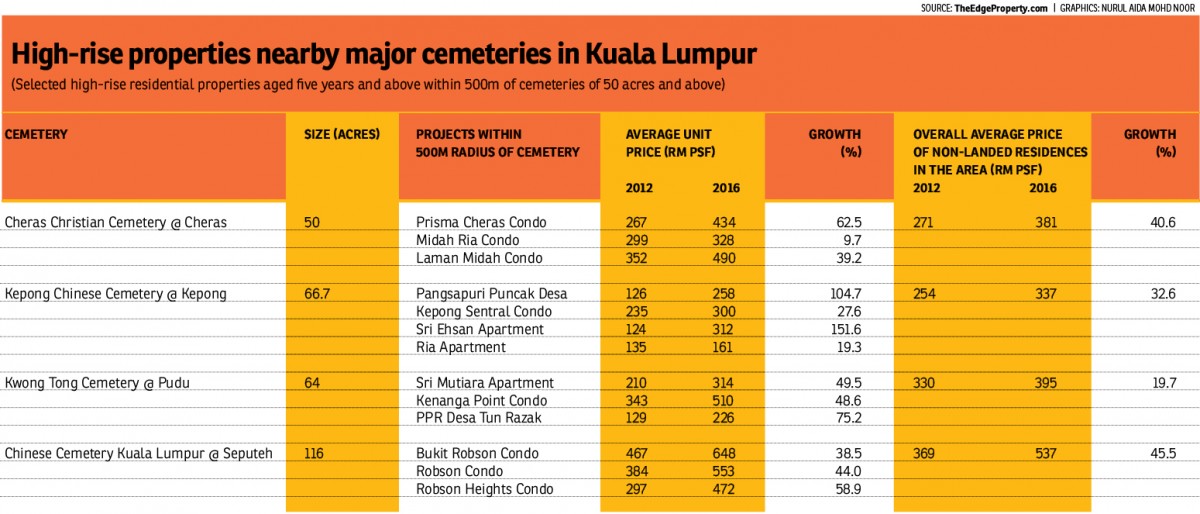

Regardless of their “inauspiciousness”, TheEdgeProperty.com research found that some non-landed residences located within 500m radius of four large cemeteries (at least 50 acres) in KL have seen significant price growth in recent years.

The cemeteries are the Cheras Christian Cemetery (50 acres), Kepong Chinese Cemetery (66.7 acres), the Kwong Tong Cemetery (64 acres) in Pudu and the Chinese Cemetery Kuala Lumpur (116 acres) in Seputeh.

Looking at the capital appreciation of some of these properties over a five-year period from 2012 to 2016, it was found that while some had shown steep capital gains over the five-year period, there were also others that saw their prices move at a snail’s pace in comparison.

At Pudu’s Kwong Tong Cemetery, for instance, three non-landed residential projects nearby had seen price growths of above 40% over the past five years.

Over in Kepong, two high-rise residences located near the Kepong Chinese Cemetery recorded more than 100% capital appreciation over the same period. This was in stark contrast to two other projects in the vicinity that only saw price appreciations of between 19% and 28%.

Meanwhile, three high-end, high-rise properties near the Chinese Cemetery Kuala Lumpur in Seputeh experienced a five-year price growth of between 38.5% and 58.9%.

And near the Cheras Christian Cemetery, two out of three samples, namely Laman Midah Condo and Prisma Cheras Condo, saw gains of 39.2% and 62.5% respectively. However, the third project, Midah Ria Condo, could only achieve 9.7% growth during the same time.

With such extreme and varied performances, one could probably surmise that location is never the sole reason in determining a property’s value.

Let’s take the selected non-landed residential properties near the Kepong Chinese Cemetery as examples. Pangsapuri Puncak Desa and Sri Ehsan Apartment, which are low-medium-cost apartments, saw 104.7% and 151.6% price growth respectively, from 2012 to 2016, while Kepong Sentral Condominium, which is a newer mid-end condominium, saw much lower price appreciation of 27.6%.

A real estate agent familiar with the Kepong areas tells TheEdgeProperty.com that the 2-block Pangsapuri Puncak Desa is one of the older high-rise properties in the vicinity. The newer ones are Sri Ehsan Apartment and Ria Apartment.

“Most of the units in Puncak Desa have built-up sizes of around 800 sq ft with average asking prices from RM180 to RM250 psf depending on their condition and views. About 30% to 40% of the units have direct views of the cemetery, and those units would have lower asking prices by probably around 30% and usually take longer to change hands,” he notes.

Overall, however, he says Pangsapuri Puncak Desa has shown higher capital appreciation compared with other newer projects including its neighbour Kepong Sentral Condominium and Ria Apartment. This is mainly because of its low entry base.

“I’m not surprised that the average price at Puncak Desa has grown over 100% over the past five years because of its low entry price. Another reason is it is located close to the main road offering easy access,” says the agent.

Kepong Sentral Condominium is a single-block condominium with facilities such as a swimming pool and children’s playground. The development gained 27.6% price appreciation over the past five years. The average asking price psf of units there is RM321 psf according to TheEdge-

Property.com listings as at June 30.

“Kepong Sentral is a good project as it offers good unit built-up size of around 1,000 sq ft. It has ample facilities and is the closest project to the Kepong Sentral KTM station. However, more than 50% of the units in the project have a direct view of the cemetery. They are very difficult to sell because Kepong has a predominantly Chinese population,” he shares, adding that Pangsapuri Puncak Desa and Kepong Sentral Condominium currently have more non-Chinese residents compared with other non-landed projects in Kepong.

Nevertheless, he shares that some investors who bought Kepong Sentral Condominium units during its launch in 2004 at around RM150 psf are still getting stable monthly rental returns from their units.

“I have an owner who rents out his unit with a slight cemetery view from one room, at RM1,200 a month, to a group of his friends who are using the KTM to travel to work daily. I think this is a good monthly income as it could cover the monthly mortgage instalment,” he notes.

Of note is Sri Ehsan Apartment, which has seen an outstanding price growth of 151.6% over the past five years.

It is a low-rise, low-cost walk-up apartment with most of the units rented out, many to the foreign workers from the factories located next to the project, according to the agent.

“This is another unpopular project when it comes to sales because it is not only located right next to the graveyard — it is also in an industrial area with factories and car workshops.

“It used to be a very quiet area until more units were rented out as staff accommodation for the factories there. This could be the possible reason the price has gone up so much in the past five years,” he says.

According to data from TheEdgeProperty.com, the indicative rental yield of Sri Ehsan Apartment is 4% with the average rental at RM0.95 psf per month.

Hence, it goes to show that no two projects are alike even if they share a location close to a cemetery.

A waiting game

Commenting on the outstanding price performances of some of the properties near cemeteries, Laurelcap’s Toh believes it has nothing to do with a change in buying behaviour.

“In my opinion, the appreciation rate within the 2012-2016 period was largely due to the last property bull run and by external market forces and not because of a new demand for properties near graveyards,” Toh says.

He rules out the possibility of a rising demand trend forming, given the generally lower asking prices of such properties.

“Prices in these projects had been stagnant for many years. Then comes the property boom, and because they have been depressed for such a long time, they caught up with almost the levels of other high-rise developments further away from the graveyards. Thus, we see a sudden surge within a short period,” he explains.

Other factors could be because other residential projects are poorly managed or maintained, making the ones near the graveyards more appealing in comparison. Accessibility to the latter could also be better compared with other high-rises in the vicinity, Toh adds.

Hartamas’ Chong does not deny that some properties near graveyards can still bring good returns to their owners.

“When the market is a buyer’s market like now, buyers are spoilt for choice, so properties near graveyards will not be considered at all. However, when the property market starts to boom, these properties will have a chance because of their lower entry points,” Chong says. “But it is also our responsibility to tell the client that it will be more difficult to change hands in future.”

She says those who do not mind having properties with a cemetery nearby are mainly the non-Chinese including Malay and Indian buyers and even expatriates from western countries and the Middle East.

“Malay and Indian clients have their own cultural taboos. When it comes to graveyard views, they are less concerned about it compared with Chinese buyers. Meanwhile, for non-Asian expatriates, most of them are fine especially if the location is in the city centre as the convenience will compensate for the graveyard view,” Chong explains.

She also points out that some property investors will not mind units with graveyard views because they are not buying for their own stay but for investment.

“What the investors are looking at is the price and location; views are not the priority. However, they must also bear in mind that it will need some time to find tenants that do not mind staying near graveyards,” she shares.

One Sunterra’s Lai agrees that buying properties neighbouring cemeteries is not unacceptable, but it will need time to reflect their value.

“While the entry price for these properties may be lower than normal projects, the time taken to get tenants or buyers is longer.

“Nevertheless, it can be considered a good buy if the sale comes with ready tenants or if the unit is located close to a large rental catchment such as college students or factory workers,” Lai concludes.

This story first appeared in TheEdgeProperty.com pullout on July 7, 2017. Download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Kundang Industrial Park (Kawasan Perindustrian Kundang)

Rawang, Selangor

Country Garden Central Park Phase 1

Johor Bahru, Johor

REDEARTH GENTING XINTIANDI

Genting Highlands, Pahang

Flat Tasek 64, Bandar Baru Seri Alam

Masai, Johor

Jalan Setia Utama U13/38C

Setia Alam/Alam Nusantara, Selangor