My aunt and her family of six live in a house they have been renting in Taman Cheras Indah, Selangor, for over 20 years now. She did contemplate buying the house after renting it for five years but concern about not being able to pay the mortgage made her settle for long-term renting. She is paying a monthly rent of about RM1,000, excluding utility charges. The initial rent was RM800 and it was only five years ago that her landlord increased the rental.

“There is no point in buying the house now since I’m not young anymore and most of my children are married or are looking to move out soon. Plus, you cannot get rental like this in the same area anymore. Similar houses like the one I’m renting in this area are asking for a monthly rental of about RM1,300 and above,” she said. She is fortunate that the rental for her unit is rather affordable. Little wonder, then, that she had decided to continue renting for so long.

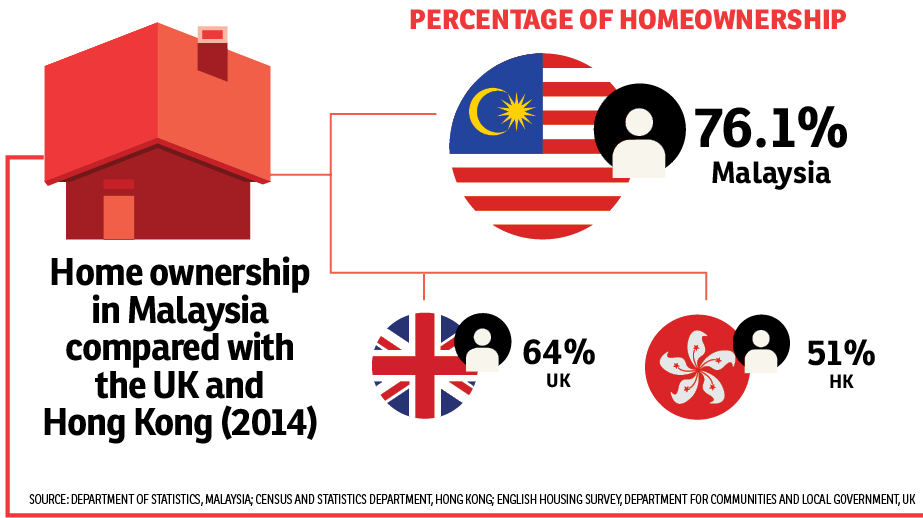

Unlike my aunt, however, many Asians including Malaysians see property ownership as one of their ultimate life goals. Renting a property as a home is generally viewed as something temporary or a transition before they find and move into their own home.

But there is no denying that there are individuals who have no intention of tying themselves to long-term mortgages even if they can afford them. And many have been renting for more than a decade.

Home ownership

Home ownership

Professor of Economics at the Business School of Sunway University Dr Yeah Kim Leng says home ownership fulfils the basic human need for shelter, while Affin Hwang Capital Research senior associate director for equity research Loong Chee Wei says property ownership is “a cultural thing” in many Asian countries.

“Asians are different. Owning a property is part of the culture and those who don’t are somehow stigmatised,” he says. Yeah concurs, as tenants are often negatively perceived as being unable to afford their own homes and are therefore seen as less successful.

Property consultancy firm CBRE | WTW managing director Foo Gee Jen also agrees. “Buying property is an established Asian value signifying stability and as extending one’s family roots,” says Foo.

According to Yeah, Malaysians also view home ownership as a long-term hedge against inflation, considering the long-term average house price increase of 4% to 5% against an inflation of around 3%.

“Malaysians also perceive property as one of the most attractive investment assets that provide both rental income and capital appreciation over the long term.

“This is proven in the higher number and longer periods of housing booms rather than bust periods. The [home ownership] obsession is therefore not unjustified, given the country’s young demographic, housing supply-demand imbalance and sustained economic growth trends,” he tells TheEdgeProperty.com.

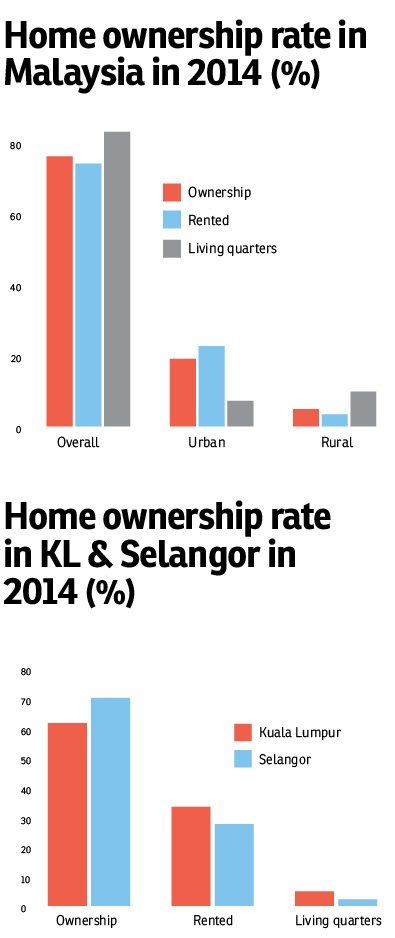

However, the renting culture is widely practised across Hong Kong and London, where property prices are high, Loong highlights.

The mortgage-to-monthly income ratio in Hong Kong is on average about 233.22%, while in London, it is about 167.12%, according to Numbeo, an online database of user-contributed city and country statistics. In Kuala Lumpur, the figure is 70.7%, while for Selangor it is 60.43%.

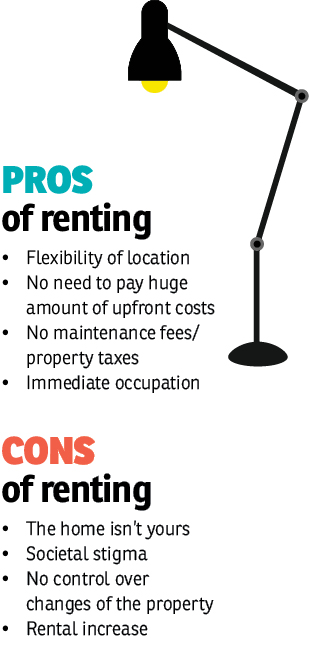

“It is a tenants’ market now especially in urban areas, because property prices are high, translating into higher mortgage, so it may not be viable to purchase a property,” suggests Loong, adding that an individual’s debt commitment against the percentage of income should be capped at 60% in order to ensure one has enough to spend on other expenses. Hence, it comes as no surprise if more Malaysians decide to rent than buy as prices creep up. It is also better to rent if one does not plan to live in an area for the long term, adds Loong.

Why rent

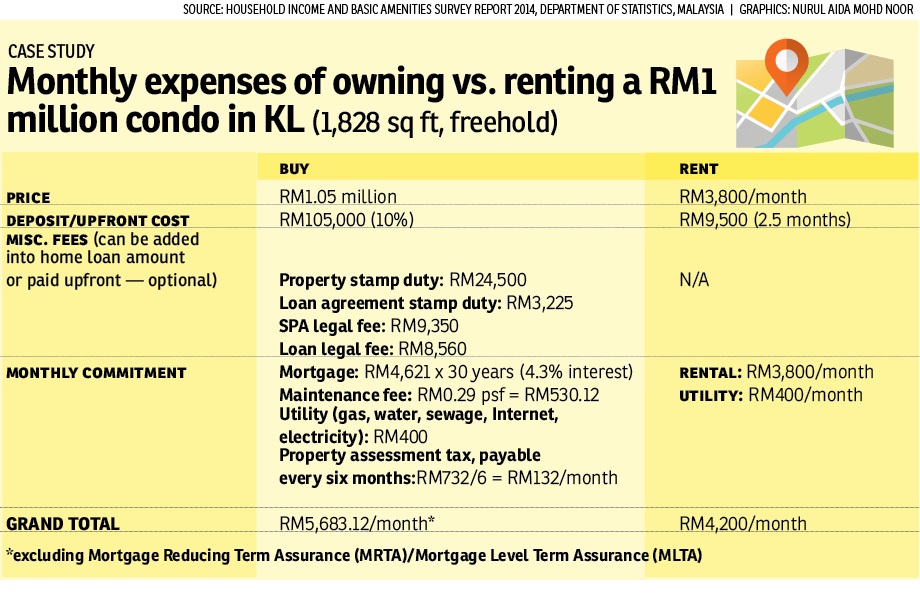

On whether one should rent or buy, Foo says it is a question of the “differential sum between the two options at the point of purchase”. Basically, which option makes more sense.

“If monthly rents are below the monthly instalments for housing loans as we see today in urban areas, then perhaps the best option is to rent,” he says.

It is a common perception that property investment will most probably offer great capital appreciation but Foo noted that house price growth has slowed in the past few years as Malaysia’s economy and infrastructure in the urban areas are peaking.

“We should be aware that rising property values in developing countries have often been driven by massive infrastructure developments as places become more accessible, coupled with the exploding demand from a fast-growing population not just in numbers but with growing disposable incomes.

“As infrastructure development peaks and population growth slows, the growth trajectory of house prices will also slow down. We believe that Malaysia has reached this stage in its economic and infrastructure development.

“While it is reasonable to see house prices doubling and re-doubling from, say, RM30,000 more than 30 years ago, what is the probability of a house currently valued at RM700,000 appreciating to a value of RM2 million in the next 30 years?

“At the end of 25 years, a housing loan of RM1 million over 25 years at 6% interest would have involved a total loan repayment of RM1,932,904. Any gains from capital appreciation would be minimal, in such a situation. Hence, the belief that ‘owning instead of renting a home is better’ needs to be reassessed,” he expounds.

Possible culture shift

Yeah notes that as the Malaysian population ages, housing supply will catch up with demand and house price growth will become more aligned with income growth. Furthermore, one can assume that more investment alternatives will be available as the financial and economic systems mature. This, he says, will lead to a more balanced buy-rent culture.

“Another reinforcing trend is that, with increased job mobility, the rental market will become more popular as house assets can be highly illiquid.

“Home ownership is welfare-enhancing to the extent that it provides security of tenure and comfort that ranks highly in the hierarchy of human needs. The cost-benefit dynamics will change, however, as income increases, society becomes more mobile and social safety nets are in place to provide greater flexibility and alternatives to home ownership,” he elaborates.

On the other hand, Foo says, purchasing properties for investment purposes is now best left to high-income families and individuals who can afford to bear the risks.

“If you are in the M40 group or have recently entered into the job market, it may be best to consider renting first as it is more affordable and gives you time to learn about the property market before making such a major investment decision,” he counsels.

The rent option would be the better decision, Yeah says, if rental remains low, interest rate and debt-servicing burden is high, house prices remain flat or are falling and there is ample supply of new houses being built that are better in quality and location.

Rent and buy at the same time

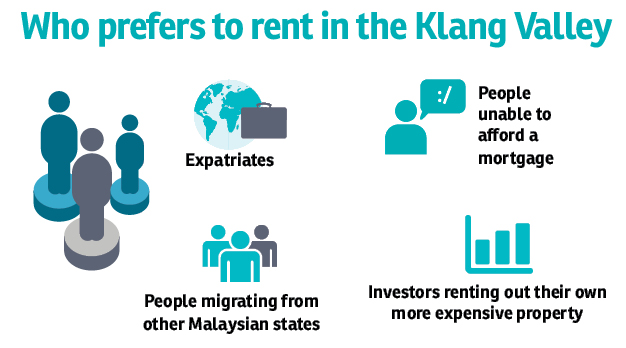

Based on MIP Properties Sdn Bhd real estate negotiator Lai Yan Yin’s observation, generally there are three types of tenants in the Klang Valley: expatriates and people from other Malaysian states moving into the Klang Valley; those who are unable to afford a mortgage; and, interestingly, investors who rent out their own more expensive property but live in cheaper rental homes.

Lai says it may be a good idea to rent if one wants to live in a coveted area but owning a place there is beyond reach. “I would advise such clients to consider renting a property in the area they fancy. At the same time, I would also recommend that they invest in a property where prices are more affordable, for future gains that would eventually assist them in purchasing his or her ideal home.

“I believe the old adage that ‘buying is better than renting’ is still relevant in today’s world. However, the interpretation needs slight tweaking. There are people who rent a place as [their] home in a more mature or established neighbourhood but invest in up-and-coming areas with high growth potential, with the long-term view of capital gains,” he says.

However, CBRE | WTW’s Foo cautions that the concept of investing in a prospective area to reap capital appreciation is very attractive in theory. “If it requires RM100,000 to RM200,000, the risks may be manageable. However, when more than RM500,000 is involved, the risks are much higher and alternative investment options must be considered.”

This story first appeared in TheEdgeProperty.com pullout on June 2, 2017. Download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Seasons Garden Residences

Wangsa Maju, Kuala Lumpur

Jasper Square, Sunsuria City

Dengkil, Selangor

Taman Sri Putra, Sungai Buloh

Sungai Buloh, Selangor

Medan Idaman Business Centre

Setapak, Kuala Lumpur

Suadamai, Bandar Tun Hussein Onn

Cheras, Selangor

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

The Parque Residence @ Eco Santuary

Telok Panglima Garang, Selangor