Well known for its strategic location, comprehensive amenities, good connectivity and accessibility, Mont’Kiara, Kuala Lumpur has gained a reputation as one of the most liveable non-landed residential areas in the Klang Valley for both locals and expatriates. What else is there to say about this high-end, high-rise residential neighbourhood on the fringe of KL city centre?

For MIP Properties Sdn Bhd senior negotiator Chong Teck Seng, much can be said about its rental market. Chong concluded more than 100 rental deals in Mont’Kiara and the nearby Sri Hartamas and Dutamas areas last year.

While others lament the slowdown in sales, rentals seem to be holding strong in that vicinity. Chong believes the condominium and serviced apartment projects in this area are popular as they offer diversity in terms of facilities, design concepts and price points, hence they are able to cater to different types of tenants.

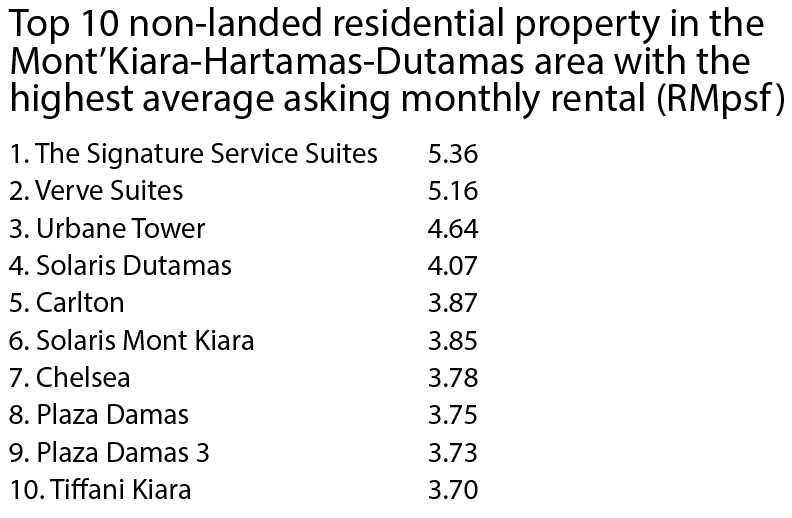

“Each condominium has its own unique selling points. The deals that I’ve concluded last year mainly came from Verve Suites, Plaza Damas 3, The Signature @ Sri Hartamas, Gateway Kiaramas and Solaris Dutamas. Each project enjoyed high demand from expatriates due to their own unique offerings, such as private lifts and units that come with bath tubs – which is considered a necessity for Japanese tenants,” Chong says.

He adds that there is strong demand from expatriates in this part of KL because it is an established expat enclave that is well-known for its amenities catered to expats living in the area including international schools. He also believes that a number of foreign companies who may not be multinational corporations (MNCs) have ventured into Malaysia to tap on the low operational cost here.

“The monthly rents for the studio, one-bedroom and two-bedroom units in the Mont’Kiara-Hartamas-Dutamas area range from RM1,800 to RM5,000 per unit, so rents are still pretty good, although some people think there is an oversupply of high-rise homes in the area,” he says.

Knight Frank Malaysia associate director of residential sales and leasing Kelvin Yip concurs that Mont’Kiara and its neighbours are popular with the expatriate community, owing to the presence of amenities such as established international schools, wide offering of F&B, retail and commercial outlets and facilities.

More new supply

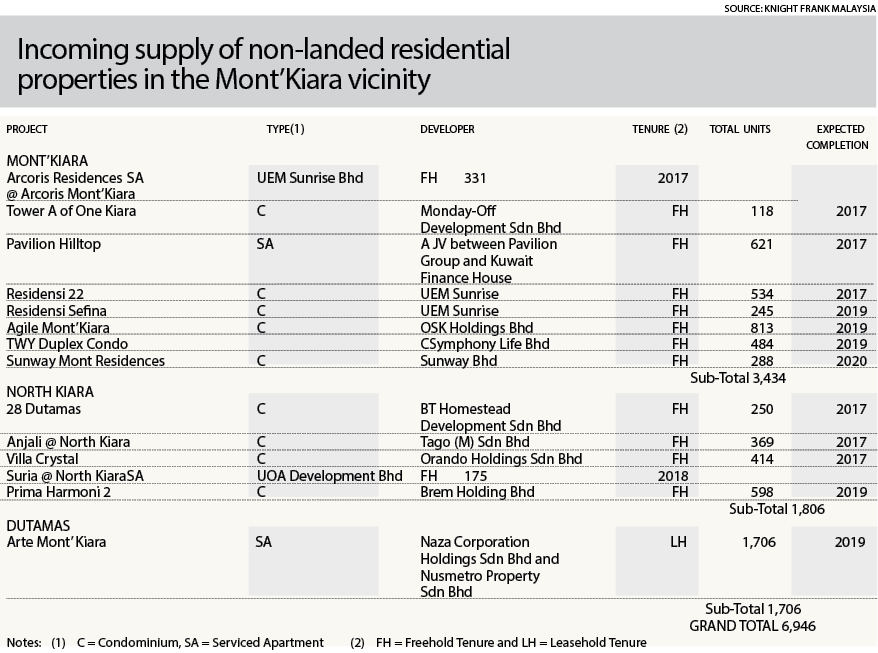

Going forward, however, Yip points out that Mont’Kiara and the locality will be ushering in an incoming supply of stratified properties such as condominiums, serviced apartments and small-office-home-office (SoHo) units, particularly along and near the light rail transit and mass rapid transit (MRT) routes vis-à-vis transit-oriented developments, such as Arte Mont’Kiara and Met 1 Residences, which are part of the 75.5-acre KL Metropolis integrated development in Jalan Duta by Naza TTDI Sdn Bhd.

Arte Mont’Kiara is expected to be completed sometime at the end of 2019. The serviced residence project is made up of three towers with a total of 1,706 units. It is a joint-venture project between Naza TTDI and Nusmetro Sdn Bhd.

Meanwhile, Met 1 Residences, which is a 55-storey serviced apartment tower that consists of 616 units, is expected to be completed in 2020.

According to previous reports, Naza TTDI deputy executive chairman and group managing director SM Faliq SM Nasimuddin had mentioned that an MRT 3 station is set to be situated in the KL Metropolis development, along Jalan Dutamas 2.

“For the MRT 3 station, we are in talks with the relevant authority. We have allocated parcels of land in the development for the proposed station,” he said at the launch of the company’s new KL Metropolis sales gallery in October 2016.

Meanwhile, Yip adds that there will be growing pressure on rents of existing and new completions, particularly in places where there is large supply in the pipeline. According to Knight Frank’s data, the current cumulative supply of non-landed residential properties in Mont’Kiara and the localities of Hartamas, Dutamas and North Kiara is about 18,000 units.

Waiting in the wings are an estimated 3,434 units of non-landed homes coming into the market this year in Mont’Kiara alone. They include Arcoris Residences @ Arcoris Mont Kiara (331 units) and Residensi 22 (534 units) by UEM Sunrise Bhd, Tower A of One Kiara (118 units) by Monday-Off Development Sdn Bhd, and Pavilion Hilltop (621 units) by a joint-venture company between Pavilion Group and Kuwait Finance House.

Zerin Properties head of research and consultancy Roja Rani Applanaidu also believes that the influx of new supply will lead to a more competitive rental market. “Owners of larger units especially may find it more difficult to rent out their units,” she says.

On the other hand, the new supply will provide more options for tenants to choose from. “Therefore, this year will be a tenants’ market with tenants having more negotiating powers in terms of rental and tenancy periods,” she adds.

Zerin Properties’ data show that the current indicative monthly rents for the non-landed residential properties in the vicinity of Mont’Kiara are from around RM3,000 to RM13,000 per unit, or RM1.80 to RM3.60 psf, while gross rental yield is about 3.5% to 5.5%. Despite the pressure from new supply, Roja believes the current rental rates and rental yields are sustainable as demand continues to be strong. “This is because of the quality projects by established developers in the vicinity, which will remain good investments and have strong demand from expats and young professionals.

“We anticipate the rental market to see some improvement from mid-2018 onwards, driven by potential rise in expat population and overall improvement to the property market,” she adds.

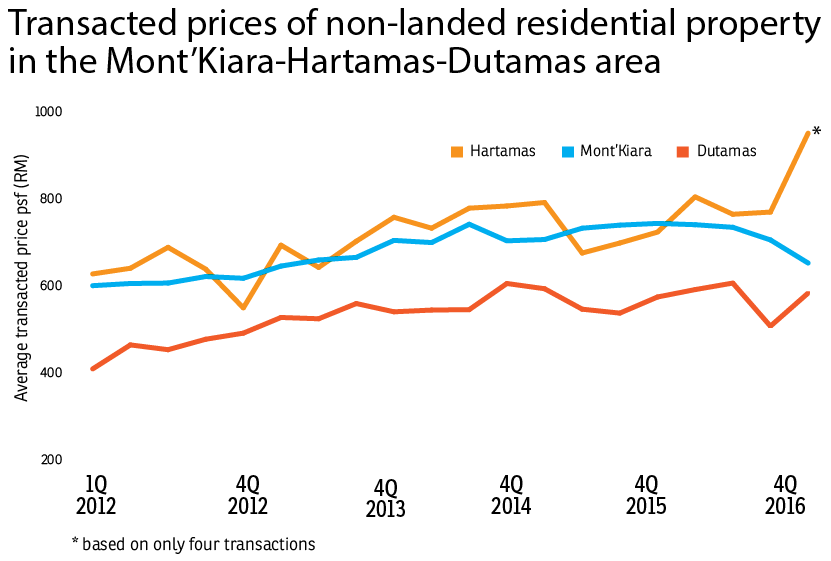

In terms of price growth, however, non-landed residences will remain flat or stable as the market has witnessed some correction.

What to look for?

Both Yip and Roja say 2017 is a good year for tenants, homebuyers and investors to shop around.

Roja advises both tenants and investors to look for units that are well-maintained and close to amenities.

“Non-landed residential units by established developers, especially within mixed developments, will be good investments as they are in line with the current trend where more young people prefer to live in mixed developments for convenience,” she adds.

On top of that, she reminds tenants, homebuyers and investors to exercise their bargaining power to get the best deal in terms of rental or price and tenancy period considering the options they have with the impending supply.

Meanwhile, Yip says it will be a good year for homebuyers to buy for own occupation as they are spoilt for choice.

For new launches, he advises homebuyers to look for developments with innovative design, state-of-the-art facilities and attractive sales incentives.

“On the secondary market, buyers should look for motivated sellers to get some good deals,” he says. “We have been getting listings in the secondary market where asking prices have been reduced for quick sale. This could be due to the property being in the market for a while. We do not see fire sales yet, but there are more motivated sellers.”

Generally, among the property sub-sectors, stratified units such as condominiums and serviced apartments are the most popular market segment among tenants, says Yip. One of the reasons is that stratified properties usually have lower entry costs than landed properties while offering attractive lifestyle living with their wide range of facilities and amenities, he explains.

In addition, stratified properties offer higher yields of 3% to 5% compared with landed properties where yields are generally in the region of around 2% or lower, he adds.

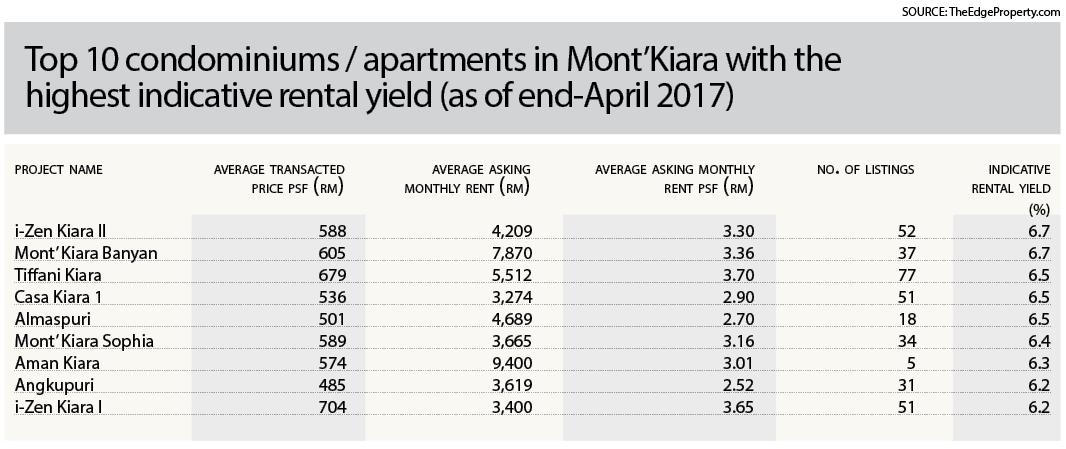

According to data from TheEdgeProperty.com, the asking rentals for non-landed residential property in Mont’Kiara range from RM2,901 to RM10,333, offering indicative rental yields between 4.29% to 5.19% as at end-2016.

This story first appeared in TheEdgeProperty.com pullout on May 19, 2017. Download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Biji Living (Seventeen Residences)

Petaling Jaya, Selangor

Palm Hill Residence 2 (Residensi Bukit Palma 2)

Cheras, Selangor

Taman Bukit Senawang Perdana

Seremban, Negeri Sembilan

DC Residensi (Damansara City)

Damansara Heights, Kuala Lumpur