ACCORDING to CBRE’s 2017 Asia Pacific Occupier Survey, global economic uncertainty and a focus on cost savings are prompting MNCs to proactively adopt workplace strategies. About 50% of MNCs will invest more in their workplace strategy and space efficiency programmes, ranking that as their main priority for the coming year.

ACCORDING to CBRE’s 2017 Asia Pacific Occupier Survey, global economic uncertainty and a focus on cost savings are prompting MNCs to proactively adopt workplace strategies. About 50% of MNCs will invest more in their workplace strategy and space efficiency programmes, ranking that as their main priority for the coming year.

Corporations across Asia-Pacific are making the realignment of workplace strategy a business priority. They are evaluating the longer-term dynamics of the workforce and thinking more holistically about the role of agile working environments in their business. As a result, corporations are coming up with workplace strategies and space efficiency initiatives to future-proof work environments, attract and retain personnel, and mitigate disruption.

Space optimisation

The increased focus on space optimisation is poised to accelerate a radical workplace change away from fixed desks to activity-based working. More than half of the survey respondents plan to implement ABW, compared with only 16% who plan to move to fixed desks. Chinese corporations are at the early stages of considering workplace strategy, while the adoption of flexible working in Japan is already high, accounting for almost half of respondents.

Implementation of workplace strategies is accelerating among corporations; survey findings reveal that MNCs are promoting flexible working by encouraging employees to share desks. Sixty-six per cent of respondents say by 2020, they will have raised the sharing ratio beyond 1:1 — up from the current 30% — meaning that the number of desks will be lower than the total number of employees.

Some companies have set relatively aggressive targets, with around 20% of occupiers planning to implement a desk sharing ratio of 1:1.4 by 2020, from just 3% currently. Implementing such a ratio is best suited to front-line functions, in business lines where employees travel most frequently or in industries such as insurance, which involve a large number of offsite client meetings.

The average space per employee is also set to decline with MNCs implementing more aggressive desk-sharing plans. While this will not necessarily involve reducing desk sizes, a higher desk-sharing ratio will naturally result in a decrease in space per head. Around 63% of MNCs have set a target of reaching a space of under 100 sq ft per employee within the next three years, up from 46% currently.

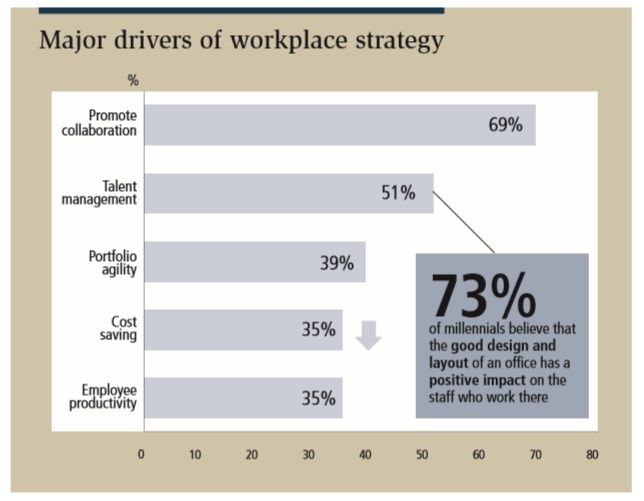

The main drivers of workplace change for MNCs are enhancing collaboration among employees, and improving talent retention and attraction. Cost saving remains a key factor (35%), but has diminished in importance compared with last year’s survey (53%). Companies increasingly realise that direct cost cutting can actually be counter-productive as it can damage employee morale and negatively affect their corporate image.

Increasing desk-sharing ratios will enable occupiers to reduce space for standard workstations and therefore increase the variety of work settings provided without having to lease additional space.

While the new norm is for flexible working in open-plan offices to foster relationship building and collaboration, noise and other disturbances are an increasing concern. Employees still need quiet spaces for confidential and focused work. MNCs displayed the strongest intentions to increase the number of focus and quiet zones and rooms. Such spaces can also be used as temporary personal offices.

Occupiers also intend to construct more social and relaxation spaces to enhance communication between colleagues. These zones can also help employees recharge during the working day. Relatively fewer respondents said they plan to increase meeting rooms and collaboration spaces, as many have already done so. The survey found stronger interest in creating a greater variety of collaborative spaces and enhancing functions within meeting rooms, such as video conferencing.

Mobile working

Mobile working is being facilitated by the advent of technology such as remote access to corporate systems and laptop computers. Half of the MNCs participating in the survey have already implemented mobile working and another 42% plan to do so, suggesting nearly all will allow mobile working in the near future.

Attitudes towards mobile working are more conservative among Asian companies, with around half of companies in Japan not allowing their staff to work from home. Asian companies traditionally place a stronger emphasis on keeping staff at their desks and do not believe working from home is productive. It should be noted, however, that some MNCs also indicated they regard working remotely from home as being detrimental to communication and collaboration. Clear data security policies should also be in place to ensure sensitive information is not compromised when employees work from home.

Greater variety of amenities

There is a general trend among MNCs to provide a greater variety of amenities to their staff. The most commonly provided facilities are coffee bars and canteens. However, as the concept of wellness gains traction, facilities such as massage chairs/rooms, games rooms and fitness centres are becoming more popular. Around 30% of occupiers currently run wellness programmes while a further 30% indicated a strong desire to introduce one in the near future.

The value of wellness initiatives is hard to quantify, but occupiers in Australia identified the main benefit as having more engaged, motivated and enthusiastic staff (75%), followed by helping to attract and retain talent (72%).

Occupiers identified child day-care centres as the top facility they would like to introduce in the future. Companies in Australia and Japan are especially keen on day-care centres as a means to attract and retain women in their workforce. There is also growing demand for childcare facilities in China as the country ends its one-child policy and families have more children, placing a greater burden on parents and grandparents.

Australia is seeing strong demand for end-of-trip facilities, including showers and bike racks for physically active and environmentally conscious employees who run or cycle to work.

Landlords filling the gap

Amenities can enhance the workplace, but only if employees actually use them. As millennials are the largest generation in the workforce, accounting for 25% of the working population in Asia-Pacific in 2016, companies should pay particular attention to their preferences.

A comparison of this survey with the findings of CBRE’s Millennial Survey published in 2016 found that of the top five amenities occupiers plan to add, wellness facilities are most aligned with the factors millennials consider when they select a new job. While occupiers place a strong emphasis on introducing concierge and dry cleaning services, these are of little interest to millennials, who would rather prefer more green space and rest areas.

High real-estate costs and limited office space will always restrict occupiers’ ability to provide a wide range of amenities on their premises. This presents a major opportunity for landlords to fill the gap by converting floors or areas of their buildings to retail, dining and other services catering to the needs of their tenants’ employees.

Growth of third-party space

Occupiers are increasingly utilising third-party office space as a tool for managing and balancing their overall office portfolio. Third-party office space is flexible offsite space that usually does not require significant capital expenditure or restrictive traditional lease terms.

Fifty-two per cent of respondents in Asia-Pacific currently use third-party space, a percentage that is expected to rise to 64% over the next three years. The preferred type of third-party space is also set to change, with serviced offices likely to be eclipsed by co-working space and innovation centres as these formats better facilitate collaboration and innovation.

Several large companies are already using these types of spaces to house temporary staff for new product development and testing new business. More occupiers, particularly tech firms, are using innovation centres and business incubators to foster an entrepreneurial culture and enable their employees to access new ideas.

Challenges remain

A key finding in this year’s survey was the rise of technology disruption as a major concern for MNCs’ future operations — jumping from 21% in 2016 to 36% in 2017 — especially for both the financial sector, as well as technology, media and telecommunications (TMT) companies.

Technology disruption is an agnostic phenomenon. For financial institutions, the rapid emergence of fintech has made investment in technology a prerequisite. In parallel, the TMT sector and the well-

established hardware and telecommunications companies, which have invested heavily in product development, may also find rapid technological change particularly costly and damaging to their business. Increased automation and the application of artificial intelligence could also reduce the number of business processing jobs.

Most companies in China, Japan and India regard cost escalation and talent availability as bigger concerns than technology disruption. This view shows that Asian companies’ strategic planning is more focused on challenges that immediately affect their operations. MNCs, on the other hand, have sufficient resources to identify and prepare for long-term structural changes.

For the second consecutive year, economic uncertainty remains the overall top concern for MNCs. Overseas political activities and geopolitical instability in Asia are set to affect their decision in regards to offshoring.

Positive intentions for headcount growth

Despite rising global economic uncertainty, MNCs hold positive intentions for headcount growth in Asia-Pacific over the next three years — 53% of respondents indicate they will increase office headcount by 2020. Among Asia-

Pacific-based companies in particular, more than 80% of Indian respondents plan to increase their headcount within the next three years, reflecting the country’s buoyant economy, steady progress in enacting regulatory reforms, and booming outsourcing and IT-enabled-services sectors. With overall robust intentions to expand by MNCs, this reaffirms confidence in Asia-Pacific’s long-term growth potential.

International corporations remain firmly focused on the stronger macroeconomic fundamentals of Asia-Pacific, but mindful of disruptive challenges. Despite a backdrop of economic volatility, tightening regulations and the mainstreaming of disruptive technology, Asia-Pacific continues to remain a long-term growth engine for both MNCs and Asia-Pacific-based companies.

Henry Chin is CBRE head of research for Asia-Pacific. This is an extract of the report on the findings of the CBRE 2017 Asia Pacific Occupier Survey.

This article first appeared in The Edge Property Singapore, a pullout of The Edge Singapore, on April 10, 2017.

For more stories, download TheEdgeproperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Kawasan Perindustrian Mount Austin

Johor Bahru, Johor

Smart Industrial Park @ SILC

Gelang Patah, Johor

Medan Idaman Business Centre

Setapak, Kuala Lumpur