The government recently announced that the seller’s stamp duty and holding period would be lowered for residential properties bought on and after March 11. The new SSD rates will be 12%, 8% and 4% of the property value for homes sold within the first, second and third year of purchase respectively. Previously, the SSD rates stood at 16%, 12%, 8% and 4% for homes sold within the first, second, third and fourth year of purchase. SSD was introduced to curb speculations.

There may seem to be no compelling reason for the government to recalibrate any property cooling measures at this juncture, given that the market is showing signs of bottoming out in the absence of active intervention. However, prices of apartments and condominiums continued to trend down for the 13th consecutive quarter in 4Q2016, suggesting that the previous macro-prudential set of cooling measures could be too stringent.

Firstly, going by the URA price index, prices now stand at 2010 levels. This puts the price increase over the past decade, between 4Q2006 and 4Q2016, at 3.6% annually on a compounded basis. It now appears that the long-term annual price increase is back to the inflationary rate, with a slight premium to account for the illiquidity of real estate.

Secondly, the uptick in transaction volume for private homes could be misinterpreted as a clear sign of market recovery. A total of 16,378 private homes were sold in 2016, up from 14,177 in 2015. While it is an encouraging sign, this was nearly 30% below the 22,719 units sold in 2013 and a far cry from 2010’s 38,900 units.

The pickup in transaction volume is also partly due to higher supply from homeowners who were compelled to sell their units. This is reflected by a surge in loss-making transactions. In 2016, about 16% of condo unit sellers incurred a loss, up from 9% in 2015.

Many of these sales also took place right after the expiry of the four-year SSD period. Analysis of URA caveats shows a number of homeowners chose to unload their units on the market right after the expiry of their SSD holding period. About one in five resale transactions in 2016, or 1,251 units, where the previous caveats can be traced, showed holding periods of between four and five years. That means the units were purchased in 2011 and 2012. In 2015, the number totalled 1,247 units, representing about one in four resale transactions in that year.

In the meantime, Singapore’s unemployment rate has crept up from 1.9% in December 2015 to 2.2% in December 2016. At the same time, the US Federal Reserve is expected to increase rates three times this year, which could dent property demand.

The calibrated adjustment of the SSD rule is therefore a timely move to address the challenges faced by the property market. It is an encouraging sign that reflects the government’s responsiveness to market forces.

Nevertheless, market watchers expect the tweak in the SSD rates to have a muted impact on the property market. Many aspiring homebuyers are still deterred from entering the market due to the continued imposition of the additional buyer’s stamp duty (ABSD).

More could be done to help the property market. The government, however, is bent on retaining the current ABSD rates. According to a joint press release by the Ministry of National Development, Ministry of Finance and Monetary Authority of Singapore, there is firm demand for private housing, in part because of the current low interest rates and continued income growth.

Recalibrating the ABSD rates would be a relief for homeowners who are compelled to sell their units. These would include homeowners who are facing financial problems or those who placed too big a stake in properties before the total debt servicing ratio was implemented. If demand is price-elastic, these sellers would have to bear the burden of the ABSD in the form of reduced prices. The continued enforcement of the TDSR and the current state of the property market should alleviate any concerns that a recalibration of the ABSD rates would lead to a surge in property prices.

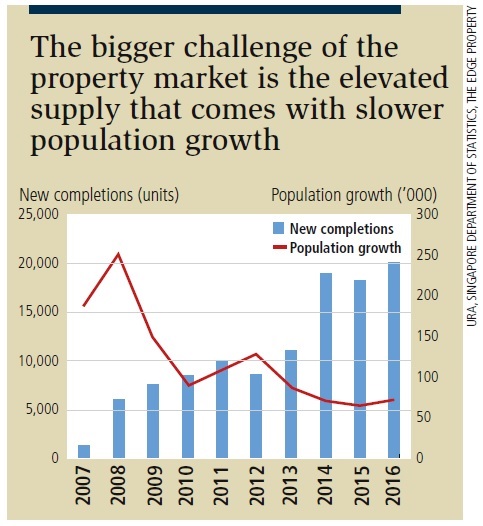

The bigger challenge in the property market, however, is the elevated supply that comes with slower population growth. Around 20,000 apartments and condo units, excluding executive condos, were completed in 2016. It was the highest annual supply seen historically, beating past records of 18,953 units in 2014 and 18,182 units in 2015.

While new supply totalled 20,000 units, the Singapore population grew only 72,281 in 2016. In contrast, the population grew 250,797 in 2008 while new supply was only 6,091 units (see chart).

The government could further moderate supply through the Government Land Sales Programme. However, developers are in the business of property development and any stagnation of development activities would leave a huge number of jobs at stake.

Perhaps the way to get around this is to relax the rules that deter en bloc sales, including the Qualifying Certificate rule and ABSD on land price. An en bloc sale involves a temporary withdrawal of supply from the market and redevelopment of the property. The benefits of higher en bloc activities would also spill over to other businesses, including business consultancies, property brokerages and construction.

In addition to tweaking the SSD, the government has also introduced the additional conveyance duty for the sale and purchase of an equity interest in property-holding entities. Before the ACD was introduced, bulk purchases of residential properties through the acquisition of an equity interest in a holding entity that owns the properties would attract a tax of only 0.2% of the entity’s net asset value. With the ACD, buyers will have to pay additional stamp duties comprising the buyer’s stamp duty at 1% to 3% and ABSD at a flat rate of 15%. SSD at a flat rate of 12% will also be levied on the seller if the properties are disposed within three years of acquisition. The new rule applies to entities whose residential properties in Singapore form at least 50% of their total tangible assets.

Separately, the TDSR will no longer apply to mortgage equity withdrawal loans with a loan-to-value ratio of 50% and below. This follows from the feedback that the TDSR framework has limited homeowners’ flexibility to borrow against the value of their properties in their retirement years.

This article first appeared in The Edge Property Singapore, a pullout of The Edge Singapore, on March 20, 2017.

For more stories, download TheEdgeproperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Medan Idaman Business Centre

Setapak, Kuala Lumpur