For most Asians, owning a piece of real estate or property means owning a legacy in the form of an asset which a family can pass on through the generations. When parents buy a property, they often have their children in mind. However, the process of inheritance can be difficult, especially when there is no will. A will must be executed for easier facilitation of the process of inheritance.

Although most property owners understand the significance of a will, it is often not a priority on their to-do list, says VKA Wealth Planners head of financial planning Lawrence Seow.

“No one likes to think about their own deaths or about what would happen to their loved ones when faced with such an event,” he tells TheEdgeProperty.com.

With or without a will, one could still inherit a property, but there is of course a difference. “With a will, it is like driving on a tolled highway while the latter is like driving on a regular congested but toll-free road,” Seow explains.

“Without a will, the governing laws will decide who is entitled to the inheritance. This means it will take a longer time for the next-of-kin to receive the estate of the deceased,” he says, adding that the court will appoint an administrator to take charge of the inheritance process and in order to produce the Letter of Administration, two sureties (or guarantors) must be available.

Founder of PW Tan & Associates Dominic Tan notes that currently Malaysia does not have any form of death tax, estate duty or inheritance tax.

Nevertheless, the legal process takes time before the ownership of the inherited assets can begin.

“This is especially true for those who are not familiar with the relevant legal procedures and tax considerations. What’s worse is that you have to go through bureaucracy and red tape whilst spending a copious amount of time and money just to get your hands on what is supposedly yours to begin with,” he adds.

Three possible scenarios

The three conditions under which a deceased can leave his or her assets are termed as testacy, partial testacy and intestacy, Tan says.

In a testacy, the deceased has left a valid will, whereby the assets will be distributed according to the terms of the will.

Under partial testacy, the deceased has left a will but it does not include his entire estate. As such, the assets stated in the will shall be distributed accordingly while the other assets will be distributed according to the Distribution Act 1958 (DA 1958).

The third scenario is intestacy, which is when the deceased has not left a valid will. Under such conditions, the properties of the deceased will be distributed according to the DA 1958.

Tan stresses that in any event, a “personal representative” (PR), either an executor or an administrator, needs to be appointed to oversee the winding up of the deceased’s estate.

“Where there is a valid will and a proving executor, probate may be granted to the executor appointed in the will. If there is no proving executor, the Court will appoint an administrator to handle the process,” he says.

“The administrator, who is appointed to manage the estate, doesn’t inherit anything unless he or she is also a beneficiary, but he or she will be responsible to pay all the deceased’s debts before proceeding with the distribution of assets,” he explains.

According to the DA 1958, the property of the deceased person, without a will, will be distributed to his or her immediate family members — parents and spouse followed by issue (children or descendants of the children who have passed away).

If a person dies leaving no immediate family member, the property will go to his or her siblings, who will share the property equally. If there are no siblings, the grandparents or other relatives will inherit the properties.

If a person passes away leaving none of the above, the property will go to the government.

Liability issues

Inheriting a property may sound like a windfall, but there are some legal implications and liability issues that the heir needs to take note of.

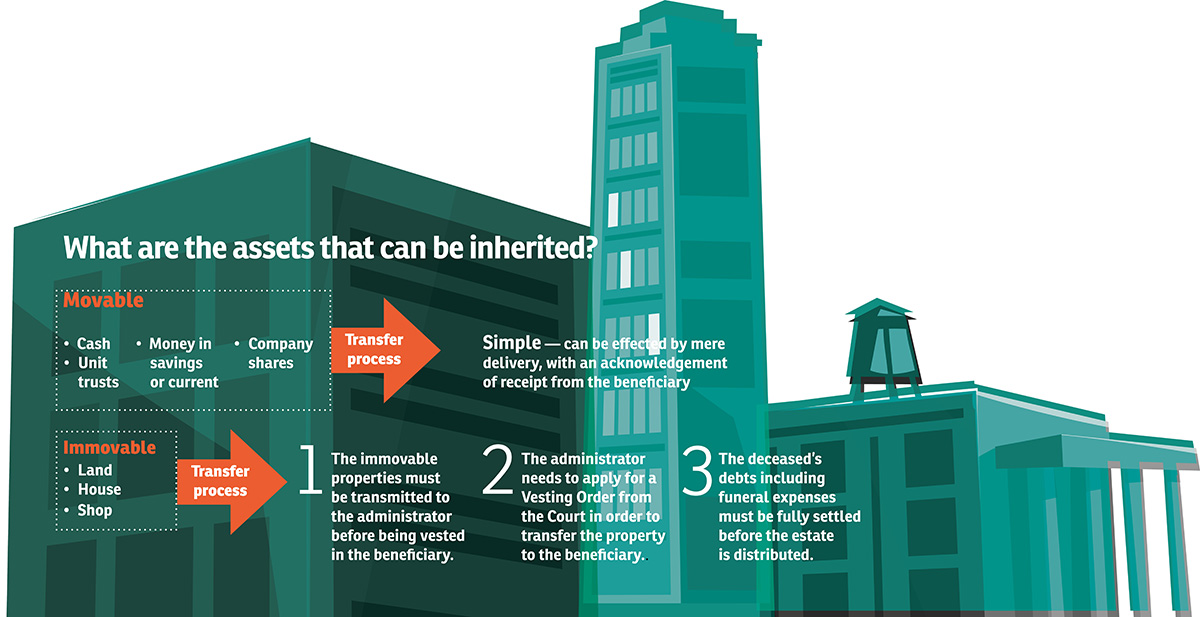

Before any of the beneficiaries can receive the inheritance, the administrator (or executor) will need to clear the debts of the deceased’s estate under the Probate and Administration Act 1959.

“All debts in the estate including income taxes must be cleared and finalised before any distribution is carried out. That means using any movable assets to offset the debts in the estate,” Seow of VKA explains.

This is where estate planning comes in. Experienced licensed financial planners can provide in-depth advice on how to optimise debt management with the proper debt cancellation plans, insurance trust, Mortgage Reducing Term Assurance (MRTA) or testamentary trust to provide proper instructions to the administrator.

Seow notes that aside from the loans attached to particular properties which one inherits, other types of debts such as personal loans and business loans will be included as well.

Estate planning for better protection

“With estate planning, the clients are doing a simulation of the whole process by identifying areas which may face financial failures if not addressed properly,” he says.

According to Seow, estate planning serves two purposes: preservation and protection. Hence, it is not only about distribution. It helps beneficiaries to inherit the property and not the debts, otherwise the creditors will seize the property and put it up for auction. Hence, beneficiaries may gain nothing in the end.

Tan from PW Tan & Associates concurs that if the estate is insufficient to cover all the debts, the beneficiary may end up inheriting nothing.

However, he says most immovable properties these days are covered by MRTA or Mortgage Level Term Assurance (MLTA), which will take care of any unsettled mortgage loans upon the decease of a property owner.

“Thereafter, the administrator may commence the process of redeeming the property from the financial institution where the property is mortgaged and have such property transferred to the intended beneficiary,” he explains.

Refinancing as another way to inherit the property

Mortgage refinancing can also be done by the beneficiary to shift the liability for repayment to the beneficiary.

However, refinancing is subject to the bank’s consent. If the bank withholds its consent for any refinancing, no transfer or sale can be done until the beneficiary has fully settled the outstanding loan sum.

Meanwhile, according to the Association of Chartered Certified Accountants (ACCA) Malaysia, if one wants to sell the deceased’s property, it will be subject to Real Property Gains Tax (RPGT).

“The administrator of the property has the duty to inform the Inland Revenue Board (IRB) of the demise of the deceased individual in a prescribed form under s74(3)(a) of the Income Tax Act and s14(4) of the RPGT Act,” states the ACCA Malaysia website.

The IRB will then issue any assessment or additional assessment (related to the deceased individual or in respect of any disposal of real property by the deceased individual) within three years after it receives the notification.

Setting a will

To avoid any family dispute over the distribution of assets and to make the inheritance process easier, Tan advises property owners to prepare a valid and enforceable will, or give away the properties during one’s lifetime via a “Deed of Gift”.

“A well-drafted and legally enforceable will could ensure that your wishes as to how to distribute your assets after your death are respected thereby reducing related conflict among your family and relatives while minimising the risk of having your will challenged for lack of clarity or on technical grounds,” Tan explains.

Besides this, it also demonstrates one’s love for the beneficiaries by minimising the hassle that they have to go through to reap the benefits of one’s assets.

“You may draft your will yourself, but in order to ensure that your will is drafted clearly and is legally enforceable, it is advisable to seek the services of professional will-writers or qualified lawyers,” cites Tan.

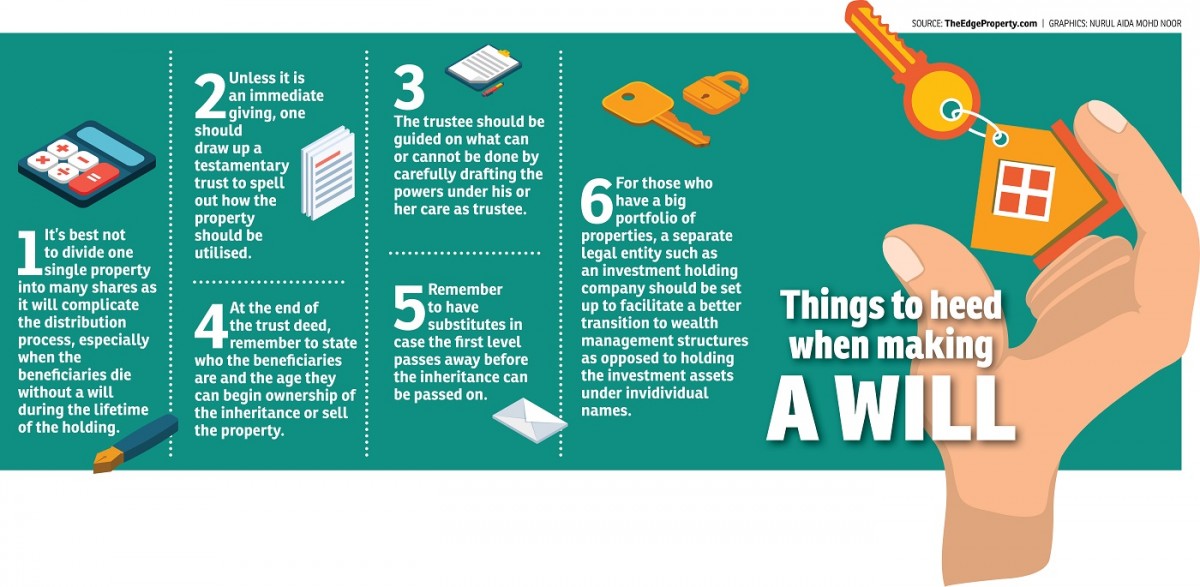

In drafting the will, Seow advises one not to divide the property into many shares.

“The more ownerships there are to a single property, the more complicated the decision-making [process] is when the time comes. Things can get even more complicated if any of the beneficiaries were to pass away during the lifetime of the holding and the beneficiary himself or herself did not have a will. The question would then be who would inherit the deceased beneficiary’s share of the estate when the owner eventually dies. A new set of beneficiaries may be invited into the property,” he explains.

Draw up a trust

Unless it is an immediate giving, Seow adds, one should draw up a testamentary trust to spell out what the property would be used for. The trustee should be guided on what can and cannot be done by carefully drafting the powers under his or her care as trustee.

“At the end of the trust deed, one needs to mention who the beneficiaries are and the age they can inherit or sell the property. Also, always have substitutes to the property in case the first level passes away before the inheritance can be passed on,” he stresses.

Meanwhile, for those who have a large portfolio of properties, especially ultra high-net-worth individuals, it is advisable to set up a separate legal entity such as an investment holding company to hold their investment assets.

Seow explains that by doing so, it will allow for a better transition to wealth management structures to hold the wealth for future generations.

Status of inheritance

Testacy

• With a valid will, assets of the deceased will be distributed according to the terms of the will.

Partial intestacy

• With an incomplete will that is insufficient to cover the entire estate of the deceased, the assets stated in the will will be distributed accordingly; while the other properties will be distributed according to the Distribution Act 1958.

Intestacy

• Without a valid will, the properties of the deceased will be distributed according to the Distribution Act 1958.

This story first appeared in TheEdgeProperty.com pullout on Feb 17, 2017, which comes with The Edge Financial Daily every Friday. Download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Bandar Sungai Long

Bandar Sungai Long, Selangor

Damansara Heights (Bukit Damansara)

Damansara Heights, Kuala Lumpur

Biji Living (Seventeen Residences)

Petaling Jaya, Selangor

P'residen, Bandar Baru Permas Jaya

Permas Jaya/Senibong, Johor

Kundang Industrial Park (Kawasan Perindustrian Kundang)

Rawang, Selangor